Fink said the influx of analytics and data could help broaden the crypto market. The CEO said in an earnings call that BlackRock is committed to producing more cryptocurrency products. BlackRock's ETF net assets are $24 billion.

As a young banker at First Boston in the early 1980s, Larry Fink pioneered the creation of mortgage-backed securities, debt instruments that would explode into a multi-trillion dollar market and reshape the housing market.

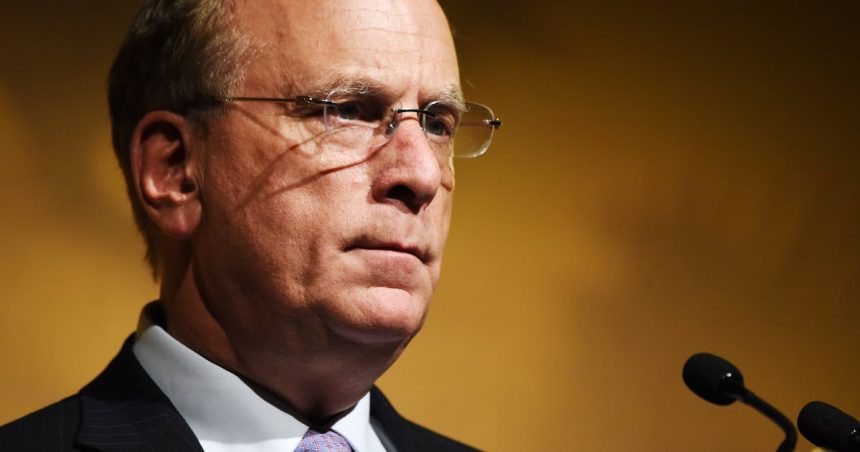

On Friday, Fink, now BlackRock's CEO, returned to those halcyon days when he discussed the emergence of a new asset class — bitcoin and cryptocurrencies.

“Years ago, when we started the mortgage market, when the high-yield market occurred, [it] Started very slow,” Fink told analysts on the company's third-quarter earnings call on Friday.

“It builds as we build better analytics and data, and then better analytics and data, more acceptance and expansion of the market,” he continued.

“I really believe that the market for these digital assets can be broadened,” Fink said.

$24 billion ETF

It's not every day that one of the most influential voices in finance touts cryptocurrencies as the new asset class that's taking the world by storm.

Fink has every reason in the world to talk about crypto given the rollout of BlackRock's bitcoin exchange-traded fund, which is now more than that. $24 billion in net assets.

And Fink compared the evolution of bitcoin to the creation of mortgage-backed securities in its early days — a link that a BlackRock representative explained News – Beating.

Join the community to get our latest articles and updates

The market for mortgage-backed securities is valued $11 trillion in 2022, according to a report by the Federal Reserve Bank of New York.

And tools that give investors exposure to a variety of real estate loans have become one of the cornerstones of Wall Street.

The expansion of the market over the decades, says Fink, is due to better analytics, better data and sector standardization. The same, he suggested, is coming for crypto.

Ethereum ETF

While skeptics take issue with his analogy, there's no mistaking Fink's bullishness on digital assets.

“This quarter, we launched our Ethereum ETF, which generated more than $1 billion in net flows in its first two months of trading and follows the successful launch of our Bitcoin product,” Fink said on a call with analysts.

“We will continue to pioneer new products by making investing easier and more affordable.”

UPDATE: A BlackRock spokesperson elaborated on the comments.

Liam Kelly is a DeFi Correspondent News. Got a tip? Email him [email protected].

Related TopicsBITCOIN ETFBLACKROCK