Bitcoin has transcended its counter-cultural roots and is now a respected asset class. Dangers remain if Satoshi's identity is revealed

An HBO documentary claims Bitcoin developer Peter Todd is the pseudonymous inventor of Bitcoin, Satoshi Nakamoto, who is worth $68 billion.

But more than a decade after the first bitcoins were created, even solving the murky mystery of Satoshi's identity no longer mattered.

Thank you Wall Street.

“Now the [Bitcoin] The network is global and robust, uncovering Satoshi's identity would have relevance only for history books or entertainment value,” said Sameer Kerbage, chief investment officer at asset manager Hashdex. News.

Adoption by finance giants such as BlackRock, Fidelity and Franklin Templeton means cryptocurrency has become a mainstream asset class.

Nakamoto's true identity, Kerbage said, “doesn't change bitcoin's fundamentals or its long-term investment case.”

downward pressure

Analysts have long worried that if Satoshi is found and alive, he risks selling his bitcoin and driving the price to the floor. Nakamoto owns 1.1 million bitcoins worth about $68 billion Dormant pouches.

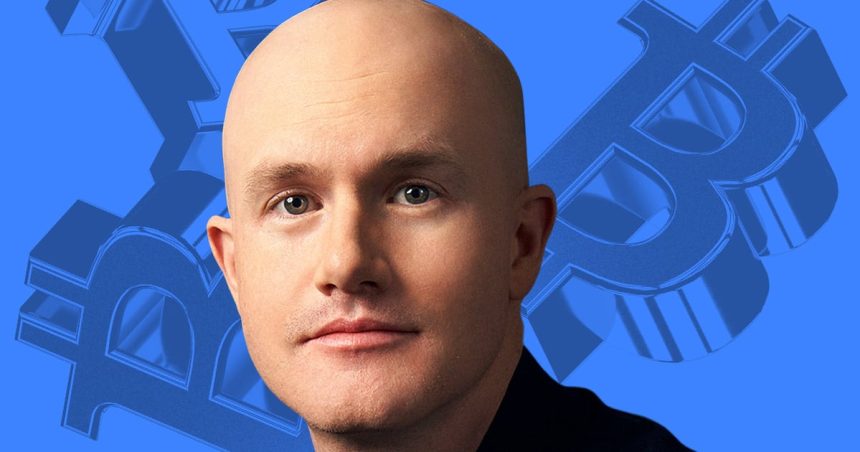

In it Quarterly reportsCoinbase lists Nakamoto's naming as a risk to bitcoin's price that investors should consider, along with inflation, monetary policy and geopolitical events.

Join the community to get our latest articles and updates

The crypto exchange holds roughly $60 billion worth of bitcoin and provides custody services for most US spot ETFs.

“If there's a faceless person behind it, it's hard to imagine they're selling,” said Adam Morgan McCarthy, a research analyst at Caico. News.

“This turns out to be a real person, which changes the perception that wallets are 'sleeping'.”

However, there are now exchange-traded funds that track bitcoin from BlackRock and about a dozen other firms. Almost Bitcoin As Satoshi did – a million, worth about $67 billion.

Nakamoto's true identity will become less and less of a factor in boosting bitcoin's price as ETFs come closer to outpacing Satoshi's holdings, McCarthy said.

Wall Street Muscles

Wall Street has always been interested in Bitcoin.

Investment banks began tinkering with blockchain in 2012, envisioning it as an alternative to the inefficient and expensive infrastructure through which financial institutions transact with one another.

They were careful to tell investors and regulators that it wasn't bitcoin — the volatile and fringe asset — they were interested in, just the underlying technology.

However, traders dove into the asset and crypto adoption gained momentum in the spring of 2021 when hedge funds like Brevan Howard set up dedicated crypto trading desks.

But a more significant development was the launch of spot bitcoin ETFs in the US earlier this year.

These ETFs represent an accessible and familiar way for ordinary investors to benefit from the price of Bitcoin, while protecting themselves from the risks inherent in direct ownership of the asset.

Investment firms are also trying to make bitcoin attractive to pensioners.

Michael Saylor's MicroStrategy firm also now owns the most bitcoin, McCarthy added — 252,220, worth about $15.5 billion.

knife edge

Most of it is Bitcoin friendly. It offers legitimacy and better infrastructure like ETFs, which means wider acceptance among investors.

However, this puts Bitcoin's future on a knife-edge between mainstream acceptance and losing its uniqueness, says Dr. Pooka Lekhi, MBA Vice-Chair in the Department of Quantitative Studies at University Canada West. News.

“While institutional adoption confirms the importance of Bitcoin, it also raises concerns that the original goal of decentralization is being diluted, moving the technology closer to the traditional systems it aims to disrupt,” Lekhi said.

Contact the authors at [email protected] And [email protected].

Related TopicsBITCOIN