The Federal Reserve is poised to cut interest rates today. Risk-on assets like Bitcoin benefit from lower borrowing costs. However, this time things may be different.

The Federal Reserve is set to cut its benchmark interest rate today.

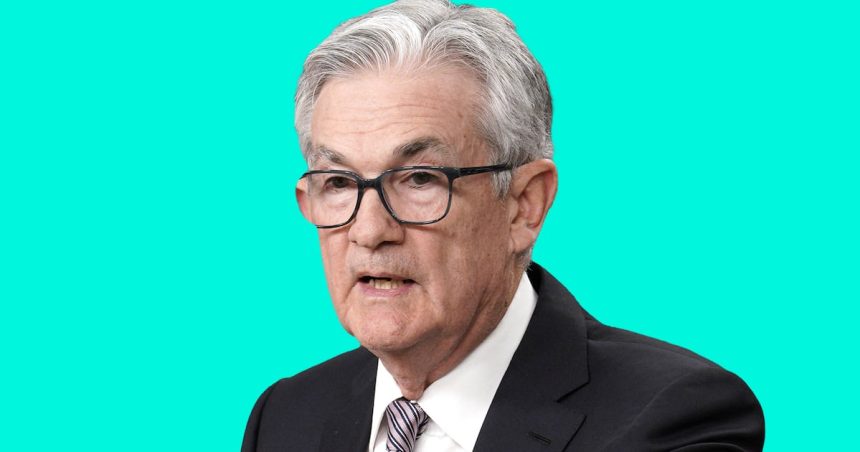

Experts see Wednesday's Federal Open Market Committee meeting as a key catalyst for crypto prices. Chair Jerome Powell is expected to announce the central bank's first interest rate cuts in four years.

Bitcoin thrives during periods of low interest rates. Low borrowing costs encourage investors towards riskier assets such as cryptocurrencies.

Here are the other factors driving the $1 trillion asset price.

Fed cuts

The cuts will depend on how aggressively the price catapults bitcoin, said Alice Liu, principal researcher at crypto data firm CoinMarketCap. DL News.

market Keeps the odds 0.25% cut at 37% and 0.5% cut at 63%.

The former boosts crypto markets, while the latter “may indicate recessionary concerns,” Liu said.

She added that “if a rate cut is perceived as a response to weakening economic conditions, it could raise concerns about future earnings growth, leading to a short-term pullback” in crypto assets.

Join the community to get our latest articles and updates

Not everyone agrees with that analysis. Mario Altenberger, co-founder of polkadot-focused crypto fund Harbor Industrial Capital, said a cut of half a percentage point would “drive a short-term rally.”

why Because he predicts it will lead to more cuts in 2024. Altenberger said a 0.25% drop would “lead to a bit of a pullback and more risk-off sentiment.” DL News.

election

The US election will also affect the price of bitcoin and be a source of uncertainty, said Dessislava Abert, senior research analyst at Keiko. DL News.

Former President Donald Trump has made several pro-crypto promises, including pledging to create a national bitcoin reserve.

Vice President Kamala Harris has not revealed her views on crypto. Crypto industry pundits interpret this as her adopting the crypto-critical stance of the Biden administration.

This fueled the so-called “Trump trade” sentiment. Bernstein analysts predict that Trump's victory could push bitcoin up to $90,000 this year, while his loss would send the cryptocurrency below $30,000.

Others, like Lecker Capital founder Quinn Thompson, reject Trump's trade idea because they say macroeconomic factors — such as Fed policy — have more influence.

Still, the election “resolves some uncertainty regardless of the outcome,” Liu said.

Fourth quarter

Some are more bullish long term.

You have “conditions ripe for price action across all markets,” says Thomas Perfumo, head of strategy at crypto exchange Kraken. DL News.

The last quarter of the year has historically been a bullish period for Bitcoin. About 90% of prices have risen between October and December over the past 10 years, Liu said.

“There's a significant chance we'll see a price pump for the rest of the year, pushing bitcoin to another all-time high,” Liu said.

Crypto market movers

Bitcoin TKTKEthereum TKTK

What are we studying?

Fed cut is here. How Bitcoin, Ethereum and Solana React – DL NewsDBS Bank to launch crypto options and structured notes for corporates in Q4 2024 – Milk RoadOdds Trump will launch a pre-election token after X space – Not boundConnect to AirDrop 185M $WCT with Wallet New Token Launch – Milk RoadArbitrum Co-Founder 'Parasite' Defends $12bn Layer 2 As Ethereum Falters — DL News

Eric Johnson is the news editor for News. Got a tip? Email at [email protected].

Related Topics Federal ReserveBitcoin