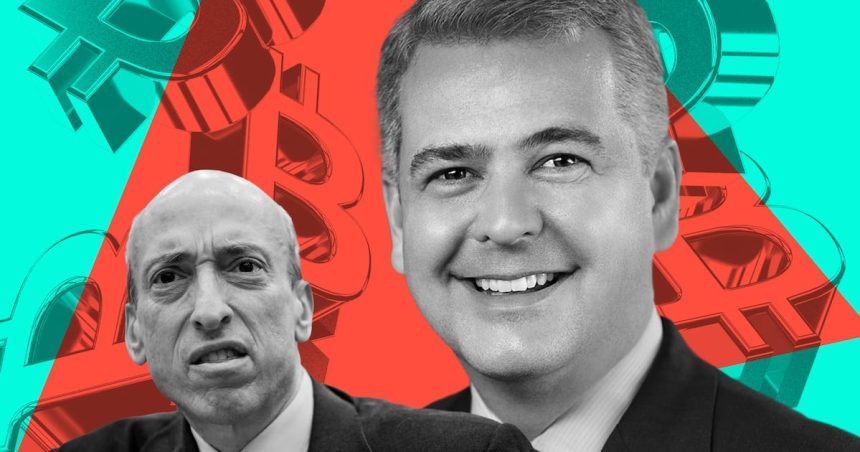

Sources say Dan Gallagher is the favorite to lead the SEC under Trump. A Robinhood executive has criticized the regulator's recent approach to crypto. Gallagher said crypto legislation could be enacted “over a six-pack of beer and pizza over the weekend.”

If Donald Trump returns to the White House, Robinhood Chief Legal Officer Dan Gallagher is favored to become the next chair of the Securities and Exchange Commission.

That's according to talks with a dozen former top regulators, lobbyists and securities lawyers. Politico Morning Money On Monday.

Gallagher, who previously served as SEC commissioner between 2011 and 2015, has been outspoken about what he calls the SEC's “scorched earth” approach to crypto regulation.

For too long, millions of Americans who want to get involved in crypto have had to “struggle with federal regulatory uncertainty that kills newcomers,” he said in September. hearing.

If Gallagher gets the job, he could dramatically shift the tone from the widely criticized “regulation by regulation” approach at the regulator to a more conciliatory tone.

But there is a lot of uncertainty. Even if Trump wins the presidency and selects Gallagher, there's no guarantee he'll accept the role.

“Don't wish that on me,” Gallagher told Bloomberg Intelligence when asked what he would do if he were head of the SEC. podcast In July. “It's a thankless job.”

Doing things differently

Despite Gallagher's reservations, he has some strong ideas about what he would do regarding crypto regulation if he were to head the SEC.

Join the community to get our latest articles and updates

On the same Bloomberg Intelligence podcast, he said, “I'll go with a very long list of things that should be overturned and overturned. “I'd seriously consider walking away from a lot of bad lawsuits.”

Gallagher did not specify which lawsuit he was referring to.

But there is no shortage of potential cases. The SEC has filed nearly 100 lawsuits against crypto firms since 2021.

Adding to that, the SEC charged Ethereum developer Consensus with offering unregistered securities sales through its MetaMask staking service in June, and threatened to sue NFT marketplace OpenSea in August.

The regulator is suing Gallagher's own firm Robinhood over its crypto trading platform.

“We've given up revenue to the company through hog wild listing coins, and I think that puts us in a very unique position,” Gallagher said. Morning moneyCommenting on a potential claim. “It's really bad policy to shoot good people.”

If he takes over, Gallagher said he would create a rulebook designed for crypto based on existing securities laws.

“They should have done it in 2021,” he said. “If they had done it in 2021, they might have caught FTX before it hit everyone.”

Perhaps the most radical comment was Gallagher's assertion of how easy it would be to create a crypto rulebook amid his instructions to the SEC.

“I could do it on the weekend with a six-pack of beer and pizza,” he said.

Who is Dan Gallagher?

Gallagher is no stranger to the inner workings of the SEC.

He is Started His career at the regulator, where he was a summer honors program intern while pursuing his law degree.

After graduation and a stint as a law firm associate in the private sector, he rejoined the SEC in 2006 and rose through the ranks to become Commissioner in 2011. He returned to the private sector in 2015 and joined Robinhood in 2020.

As he navigates the aftermath of meme stock mania centered around Robinhood in early 2021, Gallagher said he was critical of the SEC's approach to regulation.

Power play

It's not just the SEC's approach to crypto that ruffles Gallagher.

In January 2021, a coordinated social media campaign helped boost GameStop's stock by nearly 700%. In response, the SEC enacted legislation to reform the parts of the stock market responsible for extreme volatility.

“The suggestion of these rules is based on a false narrative,” Gallagher said.

He called the SEC's perception that the way financial markets are organized was the problem and that giving regulators more power would make matters “worse.”

The law — much criticized inside and outside of crypto — lays at the feet of SEC Chair Gary Gensler, appointed by the Biden administration in 2021.

Gensler's questionable performance as head of the SEC has led many in the crypto industry to call for his resignation.

Even Trump, whose presidential campaign has become crypto in recent months, has said he would immediately fire Gensler if he won the presidency.

Gallagher did not shy away from criticizing Gensler. He has yet to call for the resignation of the SEC chair.

There is Tim Craig News' Edinburgh-based DeFi correspondent. Reach out with tips at [email protected].

Related TopicsGary GenslerRobinhoodSecurities and Exchange Commission (SEC)