Investors often trade tokens and equity in private Telegram chats. Now, startups are launching millions of bespoke products. Making these deals public won't please everyone.

Secondary markets in crypto – where investors privately buy and sell their shares in companies as well as locked tokens.

Since May 2023, Activity, one of the largest secondary marketplaces on SecondLane, has recorded a 631% increase in activity.

The monthly value of its order book, or the record number of asks and bids for the company's assets, rose to nearly $900 million by July.

So, what is driving so much activity in such a liquid and opaque market?

Insiders say the recent influx of venture capital, growth in private markets and the emergence of new assets means investors can't be sold by run-of-the-mill financial institutions.

“You put a lot of private capital into a new market, you wait a few years and obviously some of these investments want to try to get initial liquidity,” said David Mirzadeh, who founded the Secondary Markets Bulletin in June 2023. News.

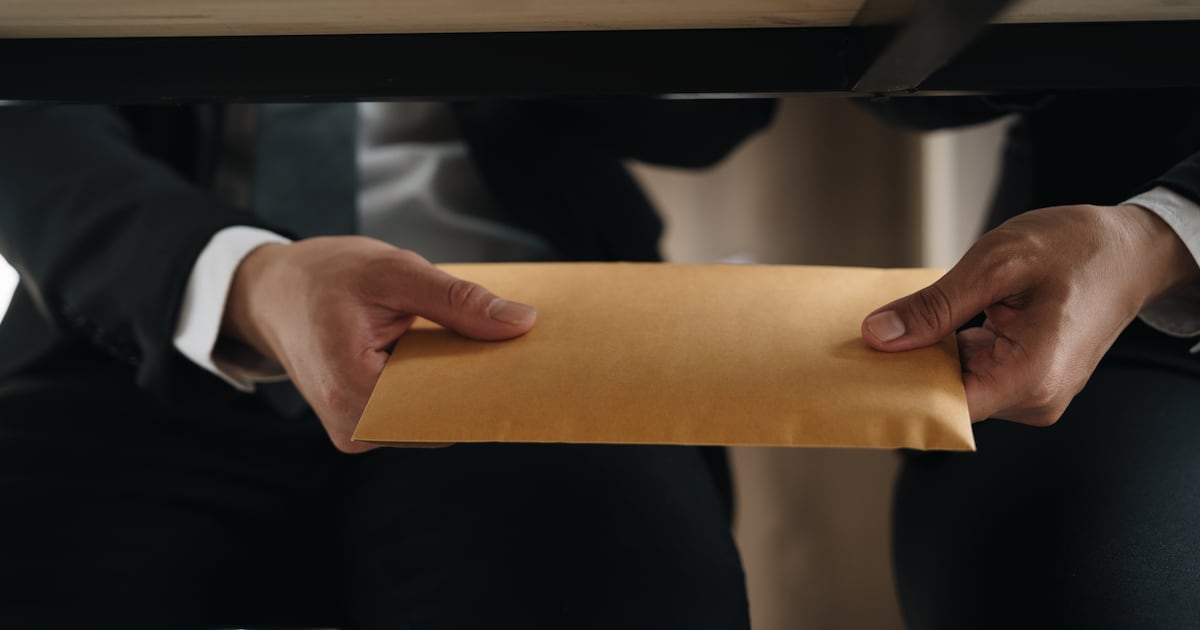

Backroom token contracts

Secondaries are traditionally liquid markets where brokers manually find buyers and sellers for startup stock and other assets between various investment rounds.

However, it is the fastest growing niche in global capital markets.

Join the community to get our latest articles and updates

According to a recent report, the volume of completed secondary deals has quadrupled from 2013 to $115 billion in 2023. Report from BlackRock. And, although the amount of private fundraising worldwide in 2023 fell year-over-year, it still doubled over the past decade to nearly $1.05 trillion in 2023. McKinsey & Company.

Deal activity in crypto is now booming due to the influx of capital investments over the past few years.

At its peak, crypto projects raised a record $7.1 billion in November 2021, per data Dephyllafrom some of the biggest names in venture capital, including Andreessen Horowitz and Tiger Global.

When the bear market hit hard after the collapse of crypto exchange FTX, VCs hoping for an exit — selling their equity in a private startup or waiting for a token launch to do the same — saw projects delayed for months without a return. Mirzadeh says he is launching new cryptocurrencies.

funds required to sell tokens; Locked tokens or cryptocurrency stashes are released to holders on set dates; and “simple contracts for future tokens,” or SAFTs, an equity-like contract that promises a holder tokens once a cryptocurrency goes live.

While crypto has attracted brand-name VCs, financial firms such as Forge Global and Goldman Sachs, which traditionally act as secondary brokers to traditional markets, have not stepped in.

These firms do not deal with these assets, said John Strandberg, co-founder and CEO of Acquire.fiSaid News.

“Forge doesn't deal in tokens at all,” he said, referring to heavyweight secondary broker Forge Global. “They just deal with equity.”

Meeting new demands

Now, crypto-native platforms like SecondLane, Acquire.fiBulletin and OFX sprung up to meet the demand.

And business boomed.

Initiated by Strandberg Acquire.fi In 2022, it says 80% of its platform's volume will be token-related.

Jonas Thiele, co-founder and CEO of OFX, said his company has facilitated nearly $600 million in secondary sales since launching in December 2023. Later this year he will open the invitation-only marketplace to more people.

There is a waitlist for his platform, but he plans to open it to the wider public later this year, Thiel said. News.

These companies aren't just catering to a new market; They also match buyers and sellers very differently than traditional brokers.

Secondaries 2.0

Mirzadeh, who serves full-time as the Near Foundation's chief of staff, used to work at Goldman Sachs and help broker secondary market deals.

“You realize pretty quickly how manual and primitive the whole process is,” he says, referring to executing secondary sales for Goldman clients. “There really isn't that much automation. Everything is done very manually. “

In fact, private, over-the-counter deals between crypto investors aren't much different.

They are usually mediated through word of mouth or Telegram, crypto's messaging app of choice.

“It's like trying to negotiate a deal in a crowded room where everyone has a slightly different version of the facts.”

– Jonas Thiele, co-founder and CEO of offx

Thiele says this is problematic.

“There are cases where four to five brokers are involved in a single transaction, leading to fees that can add up to 25% of the total volume,” he said. NewsReferring to an unnamed deal worth $2 million.

Thiele said the structure also means that information between brokers and investors can be misconstrued or not shared.

“It's like trying to close a deal in a crowded room where everyone has a slightly different version of the facts,” he said.

Telegram chats still dominate the secondary market, but some are now automated. Secondlane, Ofx and Acquire.fi Have channels that post and ask for daily bids.

Lifting the veil of the market

These platforms are lifting the curtain on what has historically been a very opaque market. Nick Cote, co-founder and CEO of SecondLane, a crypto secondaries marketplace launched in May 2023, believes more transparency is inevitable.

“The era of privacy and data compartmentalization is unfortunately behind us,” he said NewsLater adding: “Good luck keeping all these things private.”

Secondlane and Acquire.fiPost deals publicly online and act as intermediaries to connect buyers and sellers.

Others, like Bulletin, provide aggregate data from secondary trading platforms, crypto brokers, and user-sourced information.

“What we're trying to do is take what's already there in the traditional space — in terms of private market solutions, private credit — and bring that to the digital asset space,” Cote said.

'growing pains'

Anyone can join SecondLane and Acquire.fiTo the dismay of some entrepreneurs or investors who don't want to publicly know that their companies are trading at a fraction of their recent valuation, the number of deals is running high.

A quote from SecondLane understands that's a bitter pill to swallow.

“If you have portfolios that haven't been identified for years, and they're pricing these things where they're not actually close, there's going to be some growing pains,” he said.

However, he believes that projects like SecondLane are ultimately a boon to the crypto industry.

It is better to be realistic about the value of one's portfolio now than to kick the can when it is still undervalued.

“It's a new paradigm shift that's going to take some swallowing,” he said.

Ben Weiss is the Dubai correspondent News. Liam Kelly is a DeFi Correspondent News. Got a tip? Email them at [email protected] and [email protected].