The marketplace has removed and discontinued NFTs that behave like financial instruments. OpenSea instructed employees to refrain from using market terms such as 'trading' and 'broker.''Earlier this year, the SEC notified OpenSea as a target for investigation.

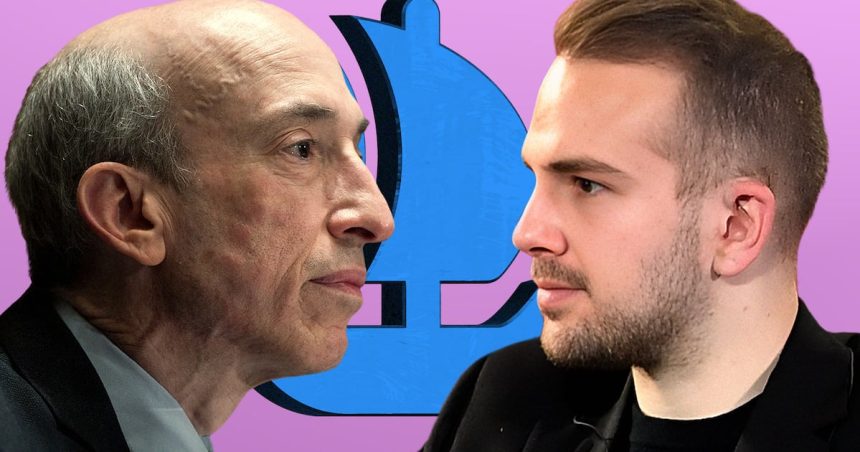

OpenSea's disclosure last month that the US Securities and Exchange Commission was investigating sparked outrage in the crypto industry.

“Irrelevant,” said Kraken founder Jesse Powell.

“American,” He tweeted Tyler Winklevoss, Gemini CEO.

Devin Finzer, co-founder and CEO of OpenSea, also weighed in.

“We were surprised that the SEC would make such a big move against creators and artists,” he said wrote that In response to an SEC letter warning of potential enforcement action.

Jokes spread online Mona Lisa, Pokemon cardsand digital sports tickets as the SEC's next potential targets. They scoffed at the idea that pictures and artwork could be considered securities and subject to federal laws.

But OpenSea, one of the largest global marketplaces for NFTs, took action to suggest that some of the NFT collections listed on its site were more than just art, according to three former OpenSea employees and company documents it had known for years. Seen through News.

Listed and discontinued

OpenSea has regularly listed or delisted non-fungible tokens, or NFTs, that behave like financial instruments. It “targets anything that holds a promise, a token, or is in any way perceived as a security,” said a person familiar with the practice. News.

Join the community to get our latest articles and updates

According to a company document, the company has issued a terminology guide instructing employees to avoid using financial terms such as “broker,” “shares,” “trading” or “exchange” in their communications.

While crypto leaders may scoff at the idea that NFTs are securities, and while Gensler and the SEC may scoff, OpenSea's longstanding efforts to weed out problematic collections complicate the narrative. Aware of the potential problems, the company took action.

A spokesman for OpenSea declined to comment on questions sent News For this article.

OpenSea tangles with the SEC in 2021 as the venture struggles to recapture the mojo that made the NFT space so messy. OpenSea's revenue grew more than 18-fold between the second and third quarters of that year to $167 million. document

Now, as the popularity of Board Ape Yacht Club and other NFTs declines, OpenSea's monthly volume About 55% fell $36 million in the past 12 months, according to Dune Analytics.

Through it all, OpenSea has worked hard to showcase several NFT collections listed on its platform.

Crippled turtles

In October 2021, OpenSea ceased trading of the collection DAO Turtles after discovering pixelated images of shelled amphibians, according to DAO Turtles' social media posts.

That means OpenSea visitors can still see NFTs, but they can't buy or sell them.

OpenSea DAO told the Turtles team that NFT collections cannot use the platform to “list, or purchase securities” and conduct financial services such as similar instruments or fundraising. A screenshot of the email.

While OpenSea didn't provide any details on why the DAO turtles raised a red flag, NFTs are more than images on the blockchain.

Owners can collect royalties from future releases and an associated cryptocurrency called Turtleshells. Archived version Project website.

Not just art

Other collections that OpenSea has removed or suspended on its site for violating the ban on financial assets Fixed stockAnd YaypegsA former employee said.

The teams behind DAO Turtles and Yaypegs did not respond to requests for comment. A Steady Stock spokesperson could not confirm why the collection was removed.

Non-fungible tokens don't just represent art. Many stand for physical goods, virtual real estate, and more.

Regulators are making the case that NFTs can be securities or regulated financial instruments. in May 2023Former OpenC employee Nate Chastain has been convicted in the first NFT insider trading case.

“We have a strong responsibility to our community and take any breach of trust very seriously” wrote that Finzer after Chastain resigned.

And Archived Reforms of OpenSea's website shows it hosted three collections, followed by charges related to the SEC's securities.

Collections – Theory of influence, Stoner catsAnd Fly Fish Club – Settled with the SEC without admitting or denying the allegations.

Terms of Service

From the beginning, OpenSea has mentioned the financial capabilities of NFTs in its terms of service.

“We are not a broker, financial institute or creditor,” reads an early archived copy of its terms of service. August 2018This is printed in all caps to hammer the point home.

Two years later, in October 2020, OpenSea was added Terms Prohibits users from “any financial activity related to registration or licensing, including but not limited to creating, listing or purchasing securities, commodities, options, real estate or debt instruments”.

'Can you use an NFT to make a securities offering? Absolutely.'

– Philip Moustakis, securities attorney

The marketplace also prohibits assets that are “redeemable for financial instruments or that give owners rights to participate in an ICO or any securities offering.”

ICO is an acronym for initial coin offering, a token distribution practice targeted by the SEC in 2018.

In 2022, the SEC began sending OpenSea information requests, The edge Reported in August. As part of that process, the company received a Wells Notice, which is a notification the agency sends to a target of a potential enforcement action. Finzer said he received the OpenC notice in August.Recently.”

Offering of securities

If the SEC sues OpenCy, the company would have to show that certain NFT collections listed are unregistered securities, said Philip Moustakis, a New York-based securities attorney at Seward & Kissel.

“Can you use an NFT to make a securities offering? Absolutely,” he said News.

Moustakis added that it's not about technology, it's about providing pieces of paper, computer code or things, or the initial sale. Citrus groves.

Generally, the SEC follows Legal guidance An asset is a security if the buyers have a “reasonable expectation of profit from others”.

On September 19, users filed a lawsuit against OpenSea for allegedly offering NFTs that behave like financial instruments.

“NFTs are treated as securities by OpenC even though they are not registered with the SEC,” maintains Adam Moskowitz, the attorney behind some of the complaints. The largest class-action lawsuits In crypto.

OpenSea has denied the claim.

“Conjuring a class action lawsuit out of thin air based on our disclosure of the SEC Wells Notice does not make the allegations in the complaint true,” an OpenSea spokesperson said. “We deny these allegations and look forward to defending against this baseless claim.”

'walk-a-mole'

It falls to OpenSea's Trust and Safety Compliance team to police the huge volume of content hitting the site day in and day out. One former staffer said the NFT marketplace's legal and regulatory teams were “dedicated beyond belief” and used computer programs to sift through the flood of content hitting the site.

“But if you take every NFT across multiple blockchains, it's just whack-a-mole,” they said.

In the third quarter of 2023, according to an internal document, OpenSea listed more than 20,000 collections that directed users to websites likely to steal users' crypto.

'If you're taking every NFT across multiple blockchains, it's just whack-a-mole.'

– Ex OpenC employee

The platform has also dealt with users attempting to list collectibles intended to membership buyers into an “exclusive wealth club”.

And it's not always easy to decipher whether a user is buying an NFT for the art or its promised rewards, another former staffer said.

(The three former employees asked not to be named because they were not authorized to speak publicly about OpenC's internal procedures.)

NFT issuers are not happy when they are flagged.

“We're constantly dealing with people who are mad about their collections being untradeable because we delisted them for potential financial reasons,” says another former employee.

According to the internal document, employees were instructed at the all-hands meeting to watch what words they use when talking to each other or the public about NFTs.

Employees are instructed to say “appreciation” or “value change” instead of “profit”.

'Fun Journey'

The DAO Turtles accordingly promises to “bring value” to its holders SiteAnd OpenSea took action.

When users could no longer buy or sell DAO Turtles NFTs on the platform, the collection cratered.

“Our project was frozen very early on OpenSea, which completely killed our momentum,” wrote the DAO Turtles team. May 2022 message On disagreement.

About a year later, the DAO turtles were released a Video game Based on its depleted NFT collection.

“This brings our story to a close,” the team wrote at the time. “It's been a fun ride.”

Ben Weiss is the Dubai correspondent News. Got a tip? Email him [email protected].

Related TopicsOPENSEANFT