Fed rate cuts could drive investors to riskier investments like altcoins. The altcoin season metric spiked following the cuts. Solana leads the top 10 cryptos, jumping 9% today as Bitcoin stagnates.

According to Presto Research analysts Peter Chung and Min Jung, the Federal Reserve's decision to cut interest rates by half a percentage point will usher in a new altcoin season.

In a research note on Friday, they argued that while cryptocurrencies other than bitcoin have a “lackluster” start to 2025, that is about to change.

“The start of the Fed's rate-cut cycle could usher in the long-awaited altcoin season,” they said.

They explained Altcoin growth has stalled due to high yields in traditional finance, which has drawn investors' attention away from riskier crypto assets such as altcoins.

However, they are “on-chain yields [could become] Even more attractive by comparison, the altcoin space has a chance to rebound and breathe.”

The US Federal Reserve's decision to cut rates by 0.5% on Wednesday boosted crypto and equity markets.

As interest rates fall, investors turn to riskier assets, including altcoins that have underperformed in recent months.

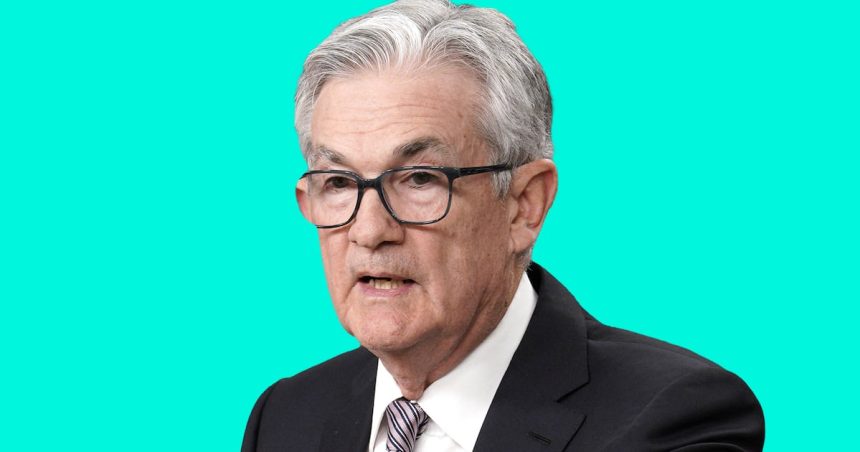

Fed Chair Jerome Powell attributed the cuts to improvements in macroeconomic conditions.

Join the community to get our latest articles and updates

Altcoin season

Data also backs up analysts' sentiment.

Blockchain Center Altcoin Season Indicator The metric shows that crypto markets are at about the halfway point between Bitcoin and so-called altcoin seasons.

This metric represents an “altcoin season” when 75% of the top 50 cryptocurrencies have outperformed Bitcoin in the past 90 days.

The last time the market moved into altcoin season territory was in January.

Solana jumped more than 9% in the last 24 hours, the most among the top 10 cryptocurrencies.

This can be attributed in part to Solana's annual conference, which began this week.

Meanwhile, Bitcoin only managed a 1.5% gain over the same time period.

Related TopicsCrypto TradingFederal ReserveSolana